Processing payroll in a timely and accurate manner is critical for business success. Maintaining salary, benefit, and tax information can be complex, which is why businesses choose to outsource their payroll. Vendors bundle, as part of their payroll processing offering, the following services: computing salaries and wages, withholding payroll taxes, administering employer-paid benefits, and filing of taxes. When selecting a vendor for payroll accounting, it is important to ensure that your vendor has experience in providing payroll services for your industry.

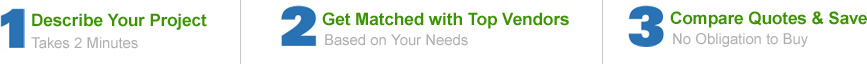

We have carefully selected top, national payroll providers that can provide high quality payroll accounting at significant cost savings. We encourage you to take two minutes to fill out the form above and get matched with leading payroll companies, who will provide you with custom payroll service quotes. For help in selecting a vendor, please check our payroll services articles, Payroll service video, and Papayroll services forums.

|